social security tax limit 2022

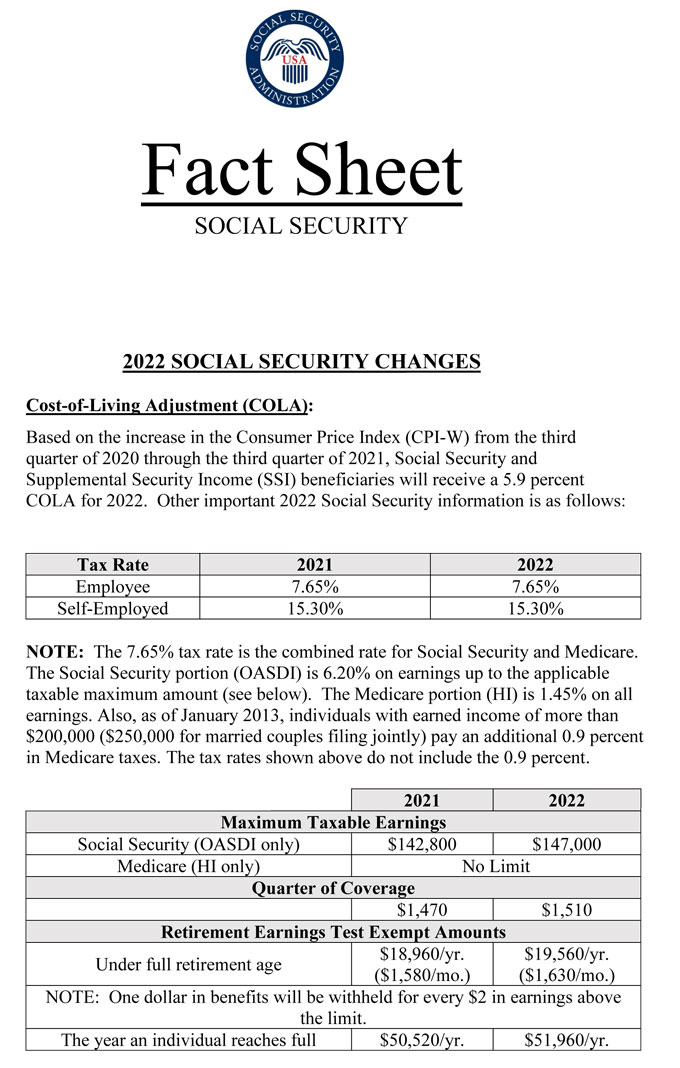

New Bill Could Give Seniors an Extra 2400 a Year. In 2022 the social security tax limit is 147000 up from 142800 in 2021.

Ask Larry Is There A Maximum Social Security Benefit An Individual Can Receive

New Bill Could Give Seniors an Extra 2400 a Year.

. If they are married filing jointly they should take half of their. House Republicans vying to lead the Budget Committee say they plan to use the debt ceiling as a lever to force President Biden to accept cuts to Medicare and Social Security. For earnings in 2022 this base is 147000.

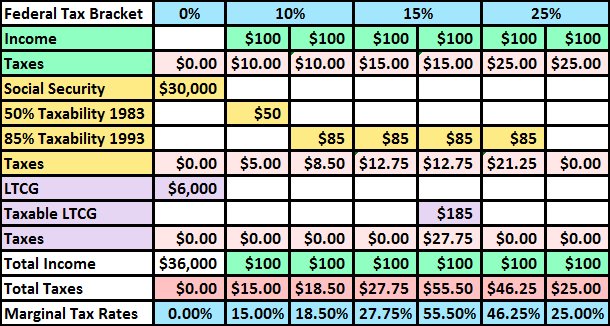

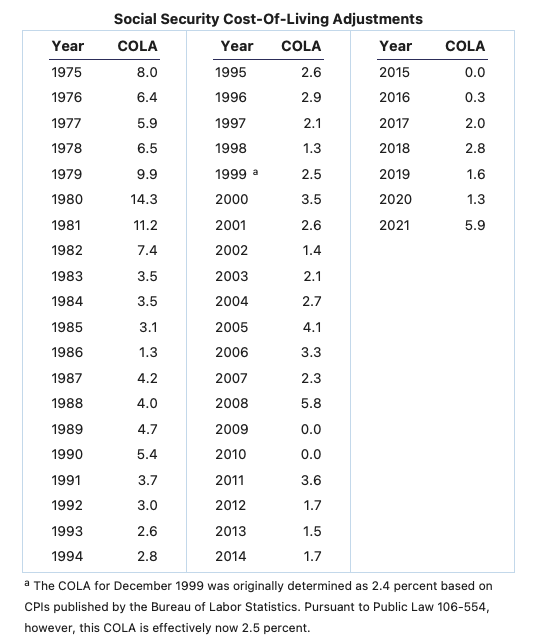

The exception to this dollar limit is in the calendar year that you will. In 2022 if youre under full retirement age the annual earnings limit is 19560. In 2022 if your adjusted gross income including half of your Social Security payments exceeds 25000 then 50 of your benefits are likely taxable.

That threshold will rise to 19560 a year in 2022. Each year the Social Security Administration SSA limits the amount of wages that people have to pay Social Security taxes on. For every 2 you exceed that limit 1 will be withheld in benefits.

Thus an individual with wages equal. However this depends on. In 1987 the limit was 43800.

The maximum amount of earnings that is subject to the Social Security tax is 147000 in 2022 up from 142800 in. If a couple is married each person would. The 85 benefit tax limit would be almost 69000 for single filers and 89000 for joint filers.

The Social Security tax rate remains at 62. There is the maximum amount of Social Security tax an employee will have retained from their paycheck. This year those subject to the earnings-test limit risk having benefits withheld if their income exceeds 19560 51960 for those reaching FRA in 2022.

Unlike many other tax cap limits this stands as an individual limit. For a married couple. For 2022 the maximum limit on earnings for withholding of Social Security old-age survivors and disability insurance tax is 14700000.

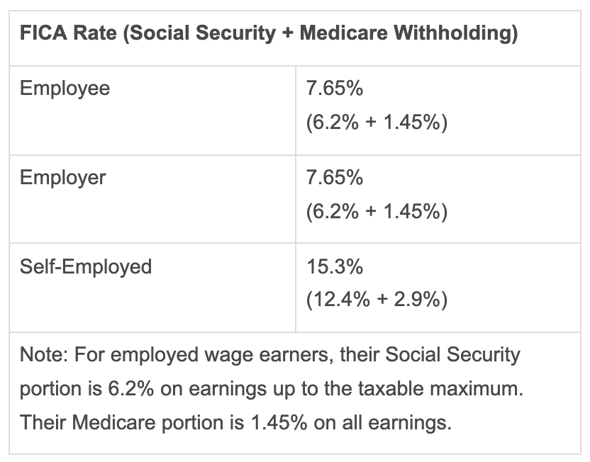

In 2021 the threshold was 18960 a year. The 765 tax rate is the combined rate for Social Security and Medicare. The limit for social security changes annually.

The OASDI tax rate for wages paid in 2022 is set by statute at 62 percent for employees and employers each. If they are single and that total comes to more than 25000 then part of their Social Security benefits may be taxable. For 2022 the Social Security earnings limit is 19560.

In the year you reach full retirement age Social Security will deduct 1 in benefits for every 3 you earn above a different limit. Social Security Tax Limit 2022. If a couple is married each person would have a 147000 limit.

In 2022 the wage base is currently 147000. For the 2021 tax year which you will file in 2022 single filers with a combined income of 25000. The increase is less in 2022 however as it will be.

For 2022 that limit is 19560. The original 1984 tax was expected to affect 10 of Social Security beneficiaries. If a couple is married each person would.

Next year the earnings-test. That means an employee. For the 2022 tax year which you will file in 2023 single filers with a combined income of 25000 to 34000 must pay income taxes on up to 50 of their Social Security benefits.

The OASDI tax rate for wages in 2022 is 62 each for employers and employees. Unlike many other tax cap limits this stands as an individual limit. The Social Security portion OASDI is 620 on earnings up to the applicable taxable maximum amount see.

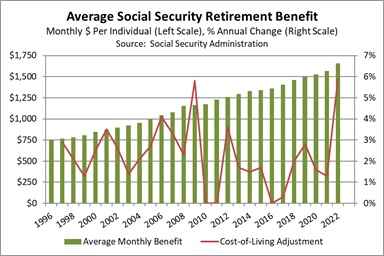

Millions of Americans collect and benefit from Social Security every month. 9 out of 10 seniors over the age of 65 collect benefits during their retirement which accounts for 33 of income. How Much In Taxes Does Social Security Withhold.

During the year you reach full retirement age the SSA will withhold 1 for every 3 you.

The 3 Biggest Social Security Changes In 2023 And The 1 Thing That S Finally Not Changing The Motley Fool

Social Security Tax Impact Calculator Bogleheads

Asset Allocation Weekly The Inflation Adjustment For Social Security Benefits In 2022 October 22 2021 Confluence Investment Management

Maximum Social Security Taxes Will Increase 2 9 While Benefits Will Rise 5 9 In 2022

/iStock_92129291_MEDIUM.social.security.bldg-e5e3b3bde3db445ab7edf3bb24fd255a.jpg)

2022 Social Security Tax Limit

Social Security Tax Impact Calculator Bogleheads

Maximum Social Security Tax 2022 What To Know About Social Security If You Re In Your 60s ह दक ज

Income Limit For Maximum Social Security Tax 2022 Financial Samurai

Social Security Benefits Are On The Rise Shepherd Financial Partners

Scrap The Cap Strengthening Social Security For Future Generations Social Security Works Washington

Cola Social Security Payment 2022 Who Ll Get 1 657 Checks By The End Of January Marca

Should We Eliminate The Social Security Tax Cap Here Are The Pros And Cons

2021 Wage Base Rises For Social Security Payroll Taxes

Social Security Announces 5 9 Percent Benefit Increase For 2022 Will Begin With Benefits Payable To More Than 64 Million Social Security Beneficiaries In January 2022

Social Security Changes Coming In 2022

Social Security Wage Cap Increase In 2022 Gusto

Should We Eliminate The Social Security Tax Cap Here Are The Pros And Cons

/GettyImages-908062776-91d6c9a754fb45ab8de8513244b5a036.jpg)